INTRODUCTION OF DIVIDEND TO THE DUTCH WITHHOLDING TAX ACT FROM 2024

26/03/2021

Under the current Dutch Withholding Tax Act (“WTA”) that was introduced on 1 January 2021, tax is levied on paid interest and royalties to recipients is low taxed jurisdictions or abusive situations. On 25 March 2021 the Dutch House of Representatives submitted a bill[1] introducing an additional withholding tax on dividend transactions to low-tax countries as of 2024, this bill had been introduced prior in 2020.

With this additional withholding tax, dividend payments to countries with no or too little tax are taxed by the Netherlands. The measures will apply to dividend transactions to countries with a profit tax rate of less than 9% and countries on the European list of non-cooperative jurisdictions for tax purposes. With this tax bill the government aims to stop the dividend distributions from the Netherlands to said low taxed countries and to further decrease dividend distributions in tax abusive situations[2].

The aforementioned taxation on dividends will be enabled by adding articles and amending articles in the current WTA[3]. An article is also added to reduce the WTA paid with (if any) Dividend withholding tax that is withheld. The withholding tax rate is equal to the highest rate of CIT. In 2021 it will be 25%. The WHT is levied on the Dutch corporate taxpayer[4].

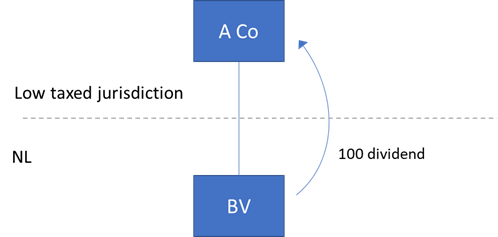

In the example below a Dutch BV distributes a dividend to an entity that the BV has a qualifying interest in, that is located in a low taxed jurisdiction. Starting from 2024 this distribution can possibly be levied with Dutch Withholding Tax.

Although this is a very simplistic elaboration on the situation of the WTA beginning in 2024, it is a realistic one. Therefore it is important to start with a suitable international company structure as soon as possible. We would glad to be of any service; as each situation is different and needs to be looked at thoroughly from a Dutch tax perspective.

[1] Rijksoverheid. (2021, 25 maart). Wetsvoorstel bronbelasting dividenden ingediend.

[2] Rijksoverheid. (2021, 25 maart). Wetsvoorstel bronbelasting dividenden ingediend.

[3] De Staatsecretaris van Financiën (2021, 25 maart) Wijziging van de Wet bronbelasting 2021 in verband met de invoering van een aanvullende bronbelasting op dividenden naar laag belastende jurisdicties en in misbruiksituaties (Wet invoering conditionele bronbelasting op dividenden

[4] Article 4.1 Withholding Tax Act

|

NAZALI TAX & LEGAL |