CARRY-FORWARD LOSS

08/01/2021

By memorandum of the amendment to the Tax Plan 2021, the Dutch cabinet accepted to limit the carry-forward loss settlement as of 1 January 2022.

This measure, which is part of other measures also taken by the Dutch government in combat to tax avoidance, limits companies to use their (large) deductible losses incurred in previous years and force them to pay at least a minimum corporate income tax on their profitable business.

In the current situation, a loss can be fully offset against last years’ profit (carry-back) or against the profits of the subsequent years up to a maximum of 6 years.

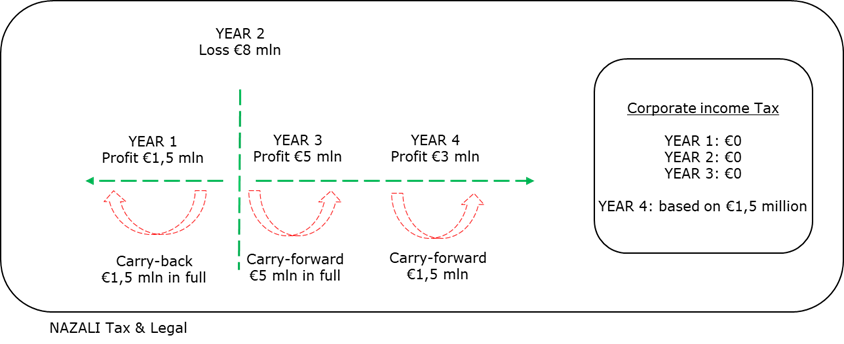

In the next visualisation the current applicability of the carry-forward loss has been clarified:

As it can be seen, the loss in year 2 is sufficient enough (i) to set-off backwards against the full profit of year 1, (ii) to offset the full profit of year 3 and (iii) to offset 50% of the profit in year 4. Eventually a company pays Dutch corporate income tax based on the remainder profit of € 1,5 million in year 4.

In the new situation a company is allowed to offset the first € 1 mln of the profit in a particular year and only 50% on the excess of € 1 mln. On the other side, the carry-forward loss can be used for an unlimited time of period as from 1 January 2022.

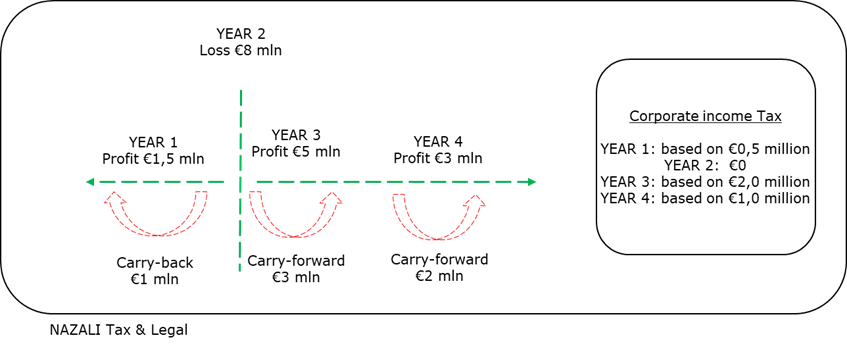

In the next visualisation the limited loss relief of the carry-forward loss has been clarified:

As can be seen, the tax base in the new situation and with the same figures delivers a taxable base of € 3,5 million for the same company in the corporate income tax sphere. The remainder loss in year 2 (€ 3 million), however, can be carried forward for an indefinite period of time.

The new situation will especially impact companies currently making losses and aim to set-off these losses against their future profits which they expect to realize on their business activities. This would also enforce companies to be more precise in forecasting its future profits to offset previous years’ losses.

This limitation measure will be applicable to losses as from the financial year 2022 or to losses still allowed to be carried forward at year-end 2021. The latter is embedded in the favourable transitional law which in most situations also includes the losses as from 2013 to be carried forward for an indefinite period of time.

Although it might be considered as a restrictive measure at the first sight, the concerning limitation of loss relief is more in line with countries such as Germany, Belgium, and the UK.

References:

- https://www.rijksoverheid.nl/onderwerpen/belastingplan/belastingwijzigingen-voor-ondernemers/belastingheffing-multinationals-commissie-ter-haar

- https://www.pwc.nl/en/insights-and-publications/tax-news/enterprises/loss-relief-becomes-limited-to-50-percent-of-the-annual-profit.html

- https://www2.deloitte.com/nl/nl/pages/tax/articles/changes-to-dutch-tax-loss-carryforward.html

- https://www.internationaltaxreview.com/article/b1p6vl15jj3rmk/a-look-at-the-proposed-loss-relief-rules-in-the-netherlands

|

NAZALI TAX & LEGAL |